|

Ethics

Behavioral finance

Doing deals

0 Comments

Matt Karatz spoke to our leadership and ethics class a few weeks ago, and it was an interesting discussion that reinforced a lot of things other speakers mentioned. Karatz has worked in the Office of Economic and Business Development for the City and in the field of real estate development as well.

He graduated from Claremont college and went to New York to become a journalist. After a lot of hard work in calling many news agencies, ABC News World Report Investigative Reporting hired him. Most of his work ended up causing him to write stories about the bad in people, and he quickly got tired of it, even though he was successful at it, receiving an Emmy for one of his stories. He transitioned to real estate and worked for KBHome. After that, he went to work for Caruso, the owner of the Grove shopping mall. Austin Beutner, whom we also heard speak in our class, reached out to him and offered him the opportunity to help him in his City post. Karatz took the position for $1 salary and ended up getting a lot done. Beutner really inspired Karatz to believe he could actually change local politics. Now, Karatz is going back to real estate. The biggest lessons he told us he learned from his experience were the following:

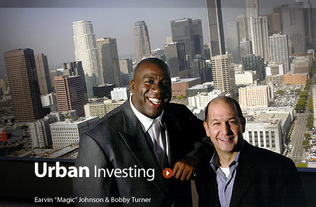

Bobby Turner was another guest speaker in my class on Leadership and Ethics, taught by former Mayor Richard Riordan. Bobby is Chairman of Canyon Capital Realty Advisors, which manages $21 billion and invests in many types of real estate opportunities. The focus of the class was on Bobby's initiatives to invest in urban neighborhoods in order to improve them and give back.

Bobby led Canyon's initiatives to partner with Magic Johnson and Andre Agassi in developing urban neighborhoods and charter schools. Bobby was trained by Mike Milken at Drexel and graduated from Wharton School of Business. Bobby explained that there are four ways to create wealth:

Bobby said that your first million dollars is the hardest to make, and wealth doesn't make happiness. He said there are four types of happiness:

The investment criteria they used were the 6 D's:

Bobby considers a fair return on capital to be 10% unlevered (levered up to 18%); after incentives, they return 12% net to investors. It was neat to hear a person so successful in real estate and for-profit investing find ways to make money while investing in projects that served a drastic need in the community even though they were unpopular. It was also fun to hear the stories of how he convinced Johnson and Agassi to get on board. |

Archives

June 2024

Categories

All

Subscribe |

RSS Feed

RSS Feed