|

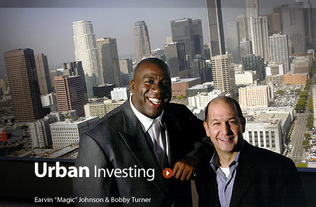

Bobby Turner was another guest speaker in my class on Leadership and Ethics, taught by former Mayor Richard Riordan. Bobby is Chairman of Canyon Capital Realty Advisors, which manages $21 billion and invests in many types of real estate opportunities. The focus of the class was on Bobby's initiatives to invest in urban neighborhoods in order to improve them and give back.

Bobby led Canyon's initiatives to partner with Magic Johnson and Andre Agassi in developing urban neighborhoods and charter schools. Bobby was trained by Mike Milken at Drexel and graduated from Wharton School of Business. Bobby explained that there are four ways to create wealth:

Bobby said that your first million dollars is the hardest to make, and wealth doesn't make happiness. He said there are four types of happiness:

The investment criteria they used were the 6 D's:

Bobby considers a fair return on capital to be 10% unlevered (levered up to 18%); after incentives, they return 12% net to investors. It was neat to hear a person so successful in real estate and for-profit investing find ways to make money while investing in projects that served a drastic need in the community even though they were unpopular. It was also fun to hear the stories of how he convinced Johnson and Agassi to get on board.

1 Comment

Yesterday, Craig Newmark came to talk to us at UCLA Anderson (Professor Jonathan Greenblatt led the conversation). It was an interesting discussion and went into many areas I wasn't expecting. Below are some of my notes and takeaways.

Overall, I was impressed by his emphasis on just doing what he thought was right, on pleasing his community, keeping his site simple and focused, and using social media and nontraditional mechanisms to promote philanthropy. A few weeks ago, I attended quite a unique talk at Anderson called, "East Meets West: What is Moral Capitalism?" It was by Dr. Hiroshi Tasaka, a distinguished business philosopher, prolific author, and founder of SophiaBank, a think tank that supports social entrepreneurs in Japan. He had flown in from Japan and spoke to a room of about 20 students over sushi (I didn't try the sushi though).

I just found online that he gave a similar talk at TEDxTokyo, which is the video embedded above. The subject of the talk was the invisible or moral values that are absent in a capitalistic culture that only focuses on economic or monetary values. These moral values are things like caring for each other, peace in the community, trust, and happiness of workers. He explained how the verb "to work" in Japanese means "to help my neighbor" (I'll see if that's true next quarter when I hopefully take a Japanese class). He taught these lessons through a philosophic fable he wrote which poked fun at how modern governments are trying to solve the current financial crises. His thesis was that by refocusing society and capitalism on a notion of invisible values, like culture, peace, and happiness, necessarily without quantifying them, we could achieve more stable and positive long-term results. The way he spoke about the moral values appealed to me and is a reason for my recent growing interest in social entrepreneurship. It was also neat to hear Tony Hsieh, the CEO of Zappos, talk to us the next day about culture at Zappos and how their core values are many of the invisible values Dr. Tasaka was preaching. I'll blog more about Tony's talk soon (which was riveting), and it was a nice coincidence to hear several speakers give their unique perspectives on a common topic. An economics professor in the audience of Dr. Tasaka's talk mentioned that there are several research studies in progress aiming to come up with a modified sense of GDP that takes into account society's contentment, peace, etc. Dr. Tasaka thought these efforts were well-intentioned but cautioned that the invisible values by definition cannot be measured or quantified. It sounded like something where you knew it when you saw it. I had also recently come across a proposal to build a social stock exchange where Social Benefit Enterprises (SBEs), or companies that are for-profit but create social good along the way, could trade and be combined into a diversified portfolio by investors who wanted to support their operations. I think all of these speakers and recent research show a growing trend towards socially responsible business, where the social good is not just a side effect but a major driver of value. It will be interesting to see how this develops in the coming years and to hopefully contribute to it as well. |

Archives

June 2024

Categories

All

Subscribe |

RSS Feed

RSS Feed